Construction growth slows as costs increase

Construction growth slows as costs increaseConstruction growth slowed down in August with nearly recorded rises in input cost inflation.

Growth sales slowed as supply chain pressures saw cost inflation grow at the second-highest rate in the survey’s 24-year history.

The IHS Markit / CIPS Uk Construction PMI Total Activity Index posted 55.2 in August, down from 58.7 in July.

Tender race starts for £4.2bn framework

Tender race starts for £4.2bn frameworkThe bid race is getting underway for a new £4.2bn framework covering major projects for public sector bodies across the UK.

The framework will last four years and a full-contract notice will be published later this month.

Work will cover sectors in construction including housing, education, emergency services, health, offices, transport, military, industrial, and commercial building services.

Construction job vacancies soar to record high

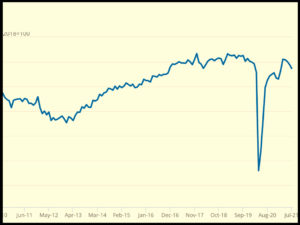

Construction job vacancies soar to record highJob vacancies in construction have risen to the highest level since official records began in 2001.

The Office for National Statistics (ONS) shows the battle to find workers to deliver projects is intensifying as companies gear up for expansion.

In the rolling three months from June to August, one of the busiest times for construction, unfilled jobs rose to 37,000, just over 15% higher than the Spring to May period and more than double the same period a year ago.

Shortages slow down construction rebound

Shortages slow down construction reboundConstruction output has fallen for the fourth month running taking new work levels 3.2% below the pre-pandemic high watermark in February 2020.

The latest official figures for output show the strong construction rebound has been halted in its track by shortages of products and materials.

Growth in the volume of output was also impacted by rising prices of raw materials such as steel, concrete, timber, and glass, according to the latest ONS report for July.

Sources:

Construction growth slows as costs “go through the roof” | Construction Enquirer News

Tender race starts for £4.2bn major projects framework | Construction Enquirer News

Construction Job Vacancies Soar to Record High – News – Buildout Recruitment

Shortages slam brakes on construction rebound | Construction Enquirer News