Construction output slides for second month running

Construction output slides for second month runningConstruction output fell 0.5% in volume terms in August in a second consecutive monthly fall.

With the wider UK economy bumping along at 2.0% growth, construction has now become a drag on growth rather than a driver.

The decreases in monthly output came solely from a decrease in new work (1.5% fall), partially offset by an increase in repair and maintenance (1.0% up) on the month.

£60m allocated to revive brownfield land for 6,000 homes

£60m allocated to revive brownfield land for 6,000 homesThe government has awarded £60m from the second tranche of brownfield land release funding to pave the way for 6,000 homes to be built

The awards to councils from Hill to Somerset will support nearly 100 regeneration projects.

The investment is part of the second phase of the £180m Brownfield Land Release Fund, with cash going directly to councils so they can release the land and get building as soon as possible.

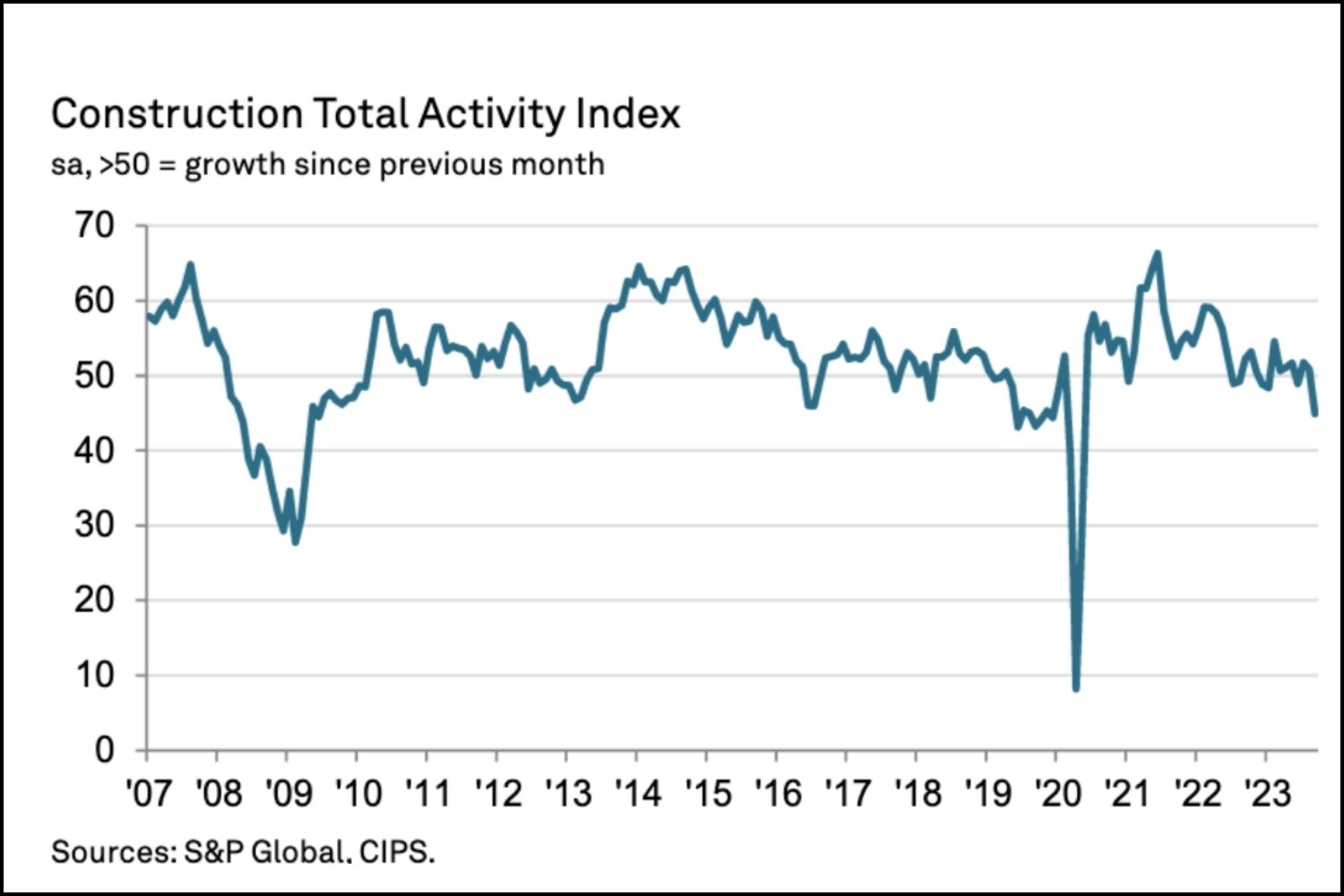

Construction buyers report September output slump

Construction buyers report September output slumpConstruction buyers reported a downturn in industry output in September for the first time in three months as industry activity declined at it fastest pace since May 2020.

All three main segments of construction work posted a reduction in business activity, led by a steep and accelerated fall in house building.

The bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index registered 45.0 in September, down sharply from 50.8 in August and below he neutral 50.0 value for the first time since June.

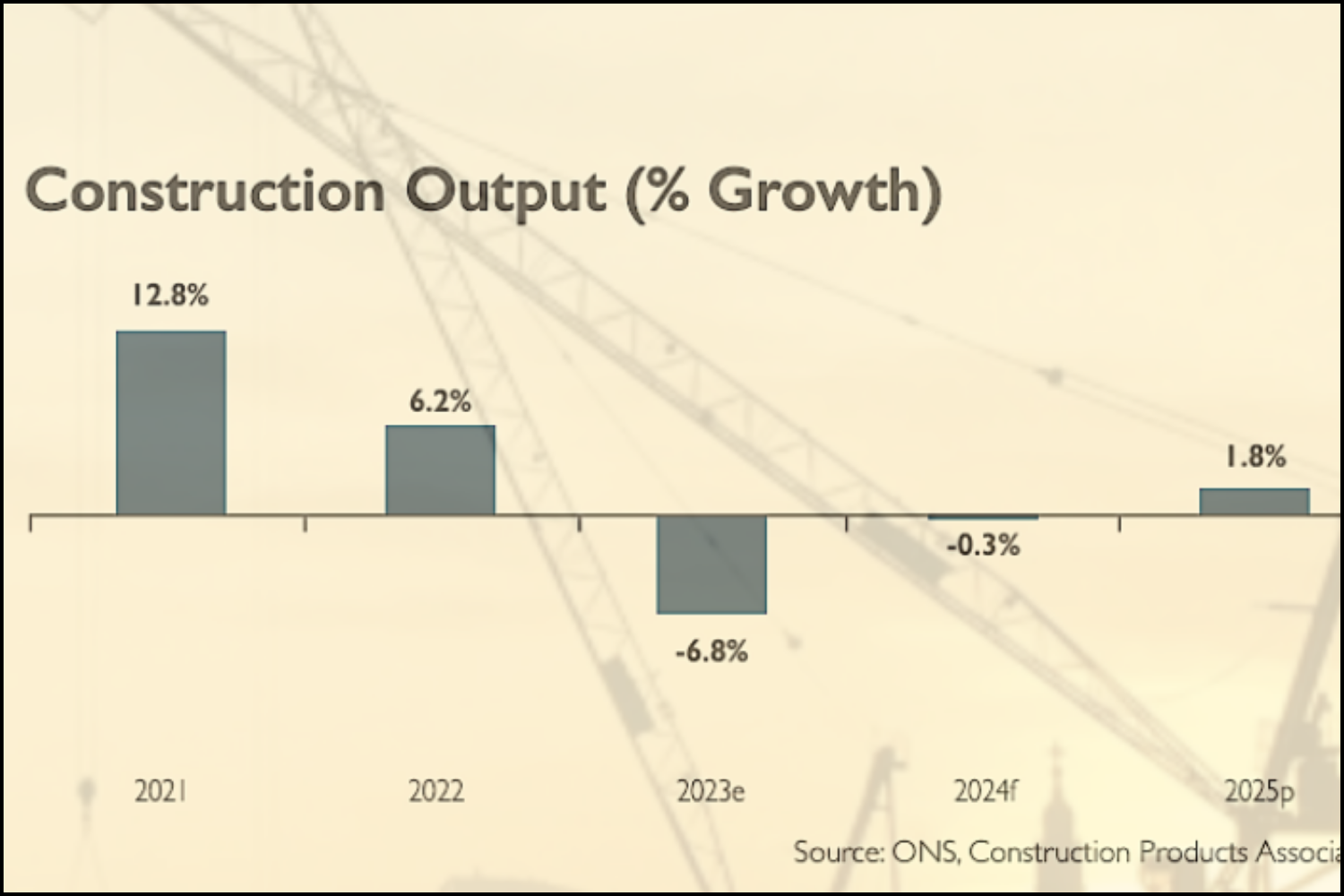

Forecasters now warn construction recession to last to 2025

Forecasters now warn construction recession to last to 2025Forecasters have downgraded the expected construction recovery next year warning the industry is now set to remain in recession until the start of 2025.

High interest rates will continue to drag down housing activity with infrastructure and even industrial activity expected to slide in 2024.

The scale of next year’s contraction will be far less then this year’s expected 6.8% fall.

According to the influential Construction Products Association’s new Autumn forecast, contractors can expect a more moderate marginal fall of 0.3% in 2024 – but down from the 0.7% growth expected for next year that was being forecast just three months ago.